Eighty-five-year-old Warren Buffett shows up in the top ten of many lists for wealth and power. His name comes to mind when the phrase “smart investor” enters in conversations around the globe. His January 2016 net worth as of this writing is $60.7 billion. A voracious reader, Buffett is known for reading 650 to 1000 pages a day during his early investing years. What did he read then or more importantly, what does he advocate reading now? Many lists exist, but we offer here 1) A Curated List, 2) A Reading Plan, and (3) A Pep Talk. We hope all three help you to reach your investing goals. We used three different lists that covered recent, but slightly different moments in time.

Financial Post (October 2014) Business Insider (October 2015) Wall Street Journal (April 2015)

The first four books on our list were common among all three websites, and then we chose the rest from those that appeared on two of the three lists. If you simply want to go out and buy the books, here are the names and authors. If you want to see what you’re buying and read a little about each one, look below for book covers and a short explanation of each one.

The Curated List of 10 Books Recommended by Warren Buffett

Sound Bite Version…

Title, Author, Quote, Number of Pages, Copyright, Year(s), Summary

1. The Intelligent Investor Benjamin Graham

“By far the best book on investing ever written.” Warren Buffett 623 Pages. Copyright 1973, updated material 2003 SUMMARY: The preface to the Fourth Edition is by Warren Buffett. This is a book of which Warren Buffett once wrote, ““Picking up that book was one of the luckiest moments in my life.” It is a classic book on value investing… 2. Business Adventures: Twelve Classic Tales from the World of Wall Street, John Brooks

“Business Adventures remains the best business book I’ve ever read.” – Bill Gates, The Wall Street Journal 459 Pages. Copyright 1953. Updated 1969 SUMMARY: Stories about Wall Street are infused with drama and adventure and reveal the machinations and volatile nature of the world of finance. The Edsel, the rise of Xerox and corporate scandals fill this book. 3. The Outsiders, William Thorndike, Jr.

“An outstanding book about CEOs who excelled at capital allocation.” – Warren Buffett 250 Pages; Copyright 2012 SUMMARY: Financial Times “Thorndike wants to give any manager or business owner the confidence to occasionally do things differently… to make the most of the cards they’re dealt and to delight their shareholders.” 4. Common Stocks and Uncommon Profits, Philip A. Fisher

“I am an eager reader of whatever Phil has to say, and I recommend him to you.” – Warren Buffett 292 Pages, Copyright 1957, 2003 SUMMARY: Philip Fisher’s investment philosophy, first published almost 60 years ago stands the test of time. With updated material by the author’s son, this book will enable the reader to make intelligent investment commitments. 5. Where Are the Customers’ Yachts? Fred Schwed, Jr.

“Schwed’s is the only financial book, out of the hundreds I’ve read, that will provoke you, teach you, and crack you up all at once. “ – Jason Zweig, Money Magazine. 170 Pages, Copyright 1940, 1955, 1995, 2006 SUMMARY: This book offers amusing observations about Wall Street along with stories about its financial players and the clients who bring them business. 6. Essays in Persuasion, John Maynard Keynes

“Essays in Persuasion is a remarkably prophetic volume covering a wide range of issues in political economy.” 384 Pages, Copyright 1940, 2009 SUMMARY from back cover: Essays In Persuasion written by legendary author John Maynard Keynes is widely considered to be one of the top 100 greatest books of all time. This great classic will surely attract a whole new generation of readers. 7. Dream Big, Cristiane Correa 264 Pages, Copyright 2013 8. Little Book of Common Sense Investing, Jack Bogle

“Most investors, both institutional and individual, will find that the best way to own common stocks is to find a fund that charges minimal fees.” – Warren Buffett 216 Pages, Copyright 2007 9. The Most Important Things Illuminated, Howard Marks

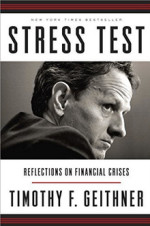

“This is that rarity, a useful book.” – Warren Buffett 180 Pages, Copyright 2011 SUMMARY by Andy Wallace: “Howard Marks, Chairman of Oaktree Capital Management, writes clearly and persuasively about the importance of risk avoidance when investing in stocks. He emphatically states his belief that risk avoidance by buying at a good value is the key to success. He then spends the rest of the book telling the reader the 18 most important things to consider when buying stocks. His discussion of investor psychology is worth the price of the book by itself.” 10. Stress Test: Reflections on Financial Crises, Timothy F. Geithner

592 Pages, Copyright 2015

Reading Plan

We’ve included the number of pages here so you can pick which book you’ll read in each of the ten months ahead of you, with two months off. Divide the number of pages by the number of days in the month, and read that many pages every day. You can also listen to books on audible.com. We know some people that “read” a book a month will have an easier time by listening to the book. You can also go back and read sections you really want to study. But listening is a great way to get through your lists.

Pep Talk

Keep reading. Read every day for which you’ve set a reading goal. Warren Buffett recommends reading books on investing so you will know what you’re doing. It’s your money, so you should know what your advisers are telling you. You will be a year older whether or not you read these books. Why not read them all? Happy reading (or listening). Featured photo credit: https://www.flickr.com/photos/katerha/ via flickr.com